From Profit to Potential: What's Next for AI?

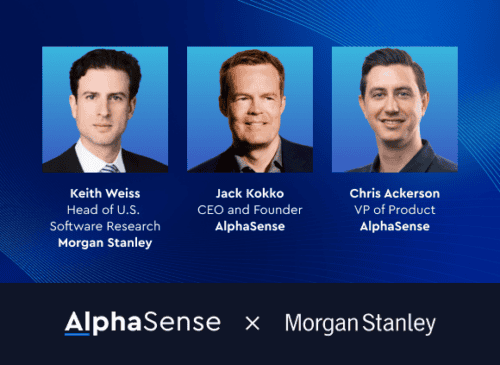

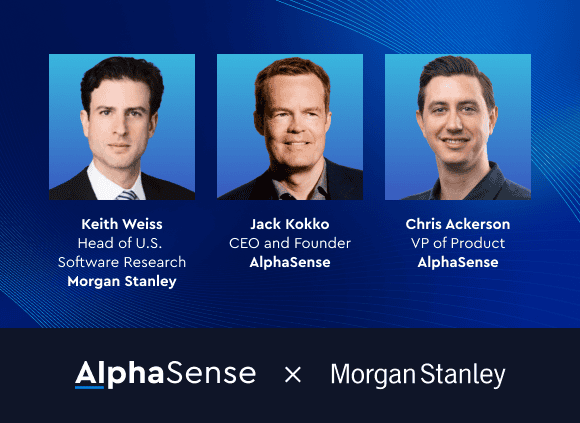

Join us May 14th for an exclusive live streamed event with Morgan Stanley to learn what Jack Kokko, CEO and Founder of AlphaSense, and Keith Weiss, Head of U.S. Software Research at Morgan Stanley, expect to unfold with AI.

see postOur customers make smarter decisions faster

Start a free trial and search our extensive universe of public and private content—including company filings, event transcripts, news, trade journals, and equity research.